Head vs. Heart: The Science Behind Decision Making

Spring 2024

Understanding the complex science behind decision making

and the divide between logical reasoning and impulsiveness

can lead to making better choices in everyday life.

Understanding the complex science behind decision making

and the divide between logical reasoning and impulsiveness

can lead to making better choices in everyday life.

Have you ever been in a situation where you have two

options but can’t seem to choose one? This could be a

decision that is as simple as what flavor of ice cream

to get or as important as choosing a college major.

Regardless of the importance, decision making is

something that we do hundreds of times each day. Even

though it's such a crucial part of our lives, the

science behind exactly why and how we make these

decisions is often overlooked.

Our brain and heart work together in a “dual-process theory.” The brain analyzes the choices presented to make a logical decision while the heart’s decision is based on instinct, desire, or impulse. Often, the heart can often override the brain. Our biases, emotions, and memories also influence the ways we approach a situation, along with the opinions of our friends and family, the media, and social norms. Unsurprisingly, it is difficult for us to make decisions in limited time, without enough information, or with limited resources available because our brain doesn’t have specific information on how to make that decision.

One field of research that is studying social, psychological, and emotional factors associated with decision making and risk assessment is behavioral economics. Studies have shown that there is a different psychological risk to being betrayed (i.e, losing your trust in someone) from the risk of losing something with value, like money or a possession. Because of this, our risk assessment is affected by our brain’s strong “betrayal aversion” and our goal to avoid this cognitive danger.

Our brain and heart work together in a “dual-process theory.” The brain analyzes the choices presented to make a logical decision while the heart’s decision is based on instinct, desire, or impulse. Often, the heart can often override the brain. Our biases, emotions, and memories also influence the ways we approach a situation, along with the opinions of our friends and family, the media, and social norms. Unsurprisingly, it is difficult for us to make decisions in limited time, without enough information, or with limited resources available because our brain doesn’t have specific information on how to make that decision.

One field of research that is studying social, psychological, and emotional factors associated with decision making and risk assessment is behavioral economics. Studies have shown that there is a different psychological risk to being betrayed (i.e, losing your trust in someone) from the risk of losing something with value, like money or a possession. Because of this, our risk assessment is affected by our brain’s strong “betrayal aversion” and our goal to avoid this cognitive danger.

"Often, the heart can often override the brain. Our

biases, emotions, and memories also influence the ways we

approach a situation, along with the opinions of our

friends and family, the media, and social norms."

Neuroeconomics, another field that analyzes our brain,

uses methods such as functional magnetic resonance

imaging (fMRI) that can see the anatomy and physiology

behind decision making. fMRI allows researchers to

determine which sections of the brain are working the

most during certain tasks like crossword puzzles or

psychological mind games. Scientists can then use these

findings along with other cognitive experiments to

determine how your brain uses information in decisions.

For example, research has deduced that the neuropeptide

hormone oxytocin affects how much trust we have in other

people. The oxytocin hormone is created in the

hypothalamus, the section of the brain that regulates

the hormones in our body and keeps us in a stable state

of homeostasis. Additionally, oxytocin is known to

moderate social behavior in humans and animals, which

aligns with its role of managing trust.

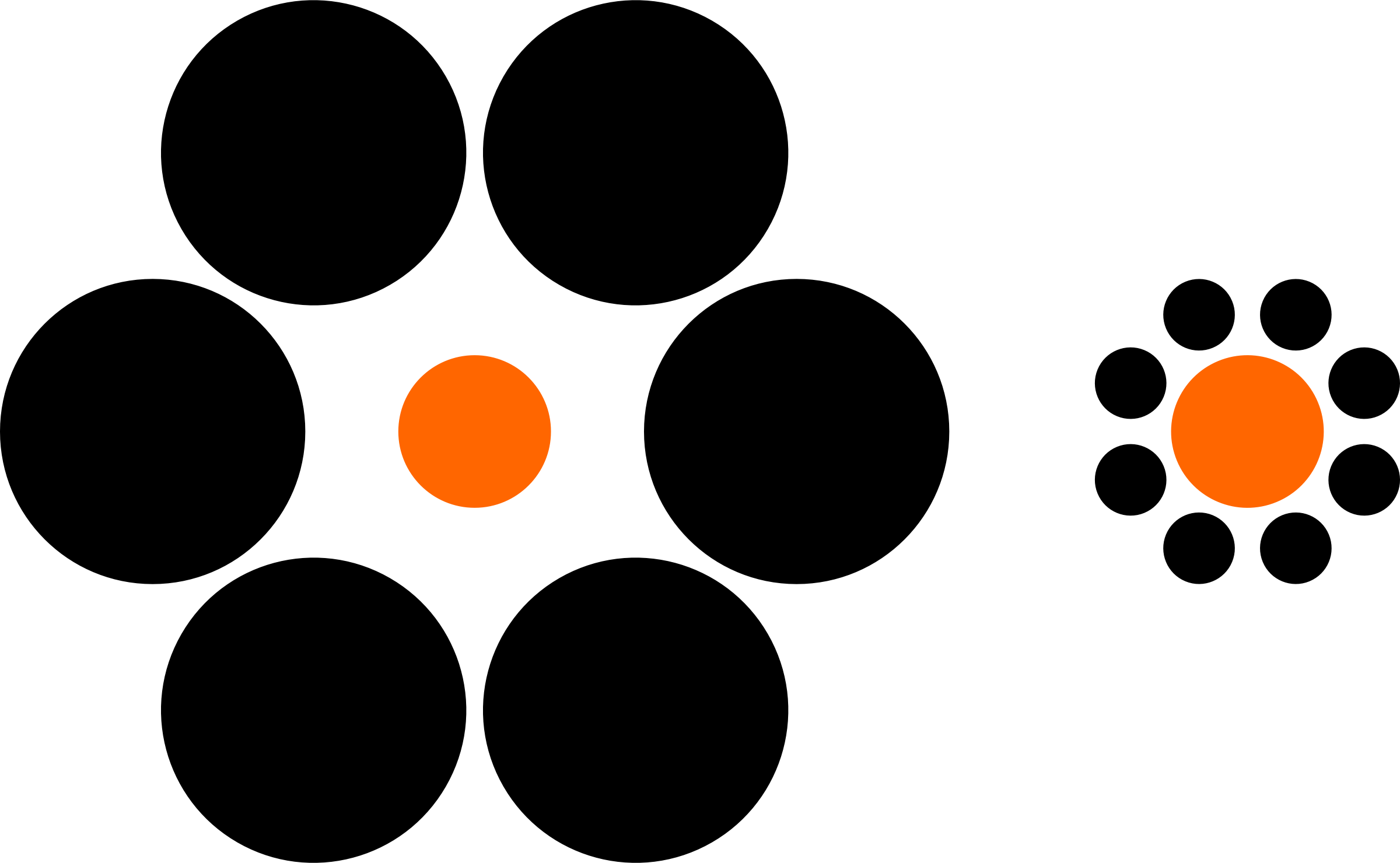

The context of a situation also plays a role in how risk and decisions are evaluated. One simple, common example is the Ebbinghaus Illusion. In Figure 1, the yellow dots in the middle are the same size, but because of the spacing and size of the gray dots around them, the dot on the right appears to be larger. Even though this illusion has been tediously studied, the neural and perceptual mechanisms responsible for this effect continue to be debated among scientists.

The context of a situation also plays a role in how risk and decisions are evaluated. One simple, common example is the Ebbinghaus Illusion. In Figure 1, the yellow dots in the middle are the same size, but because of the spacing and size of the gray dots around them, the dot on the right appears to be larger. Even though this illusion has been tediously studied, the neural and perceptual mechanisms responsible for this effect continue to be debated among scientists.

Scientists have also researched how misinformation affects

the brain. In our current world, we consume information

from many different sources including social media, the

internet, and television. Our brain automatically has a

neurological bias (to a certain extent), which can be

difficult to alter when presented with alternative facts.

Thus, if we take in incorrect information first, it is

increasingly challenging to update our memories when we

are met with the correct facts, which consequently affects

our judgment. Surprisingly, this occurs even if we are

aware that the original information was incorrect or if we

are informed ahead of time that we will be receiving

misinformation. Scientists call this “continued influence

effect of misinformation.”

Scientists have also researched how misinformation affects

the brain. In our current world, we consume information

from many different sources including social media, the

internet, and television. Our brain automatically has a

neurological bias (to a certain extent), which can be

difficult to alter when presented with alternative facts.

Thus, if we take in incorrect information first, it is

increasingly challenging to update our memories when we

are met with the correct facts, which consequently affects

our judgment. Surprisingly, this occurs even if we are

aware that the original information was incorrect or if we

are informed ahead of time that we will be receiving

misinformation. Scientists call this “continued influence

effect of misinformation.”

But if we have all of this information, bias, experience, and context that contributes to our decision making process, why can we be so indecisive at times? Researchers have investigated this behavior and termed it indecision or decisional procrastination. Indecisiveness is not lazy, but it is the avoidance of needing to make a typically stressful or important decision. Delaying a decision is seen as a strategy of avoiding the imagined negative consequences altogether, but putting it off is only a short-term solution that leads to more anxiety and stress in the long term.

If indecisiveness is bad for the long term, why is it so easy to fall into the trap of decisional procrastination? Studies have shown that the logical side of our brain that understands long-term goals and consequences is in a constant fight with the emotional, impulsive side. When we get really close to getting a reward, our emotional brain wins because of all of the dopamine that is released. Later, when our brain calms down later, our logical side gains back control and we may regret the decision.

All in all, we are in a constant tug-of-war between rational analyzing and emotional impulsiveness. Whether this leads to a quick choice or prolonged indecision, understanding the science behind decision making can help us make more informed and efficient decisions in our everyday lives.

Sources:

https://openclipart.org/image/2400px/svg_to_png/269872/EbbinghausIllusion.png